Navigating Wind Damage from Hurricane Helene

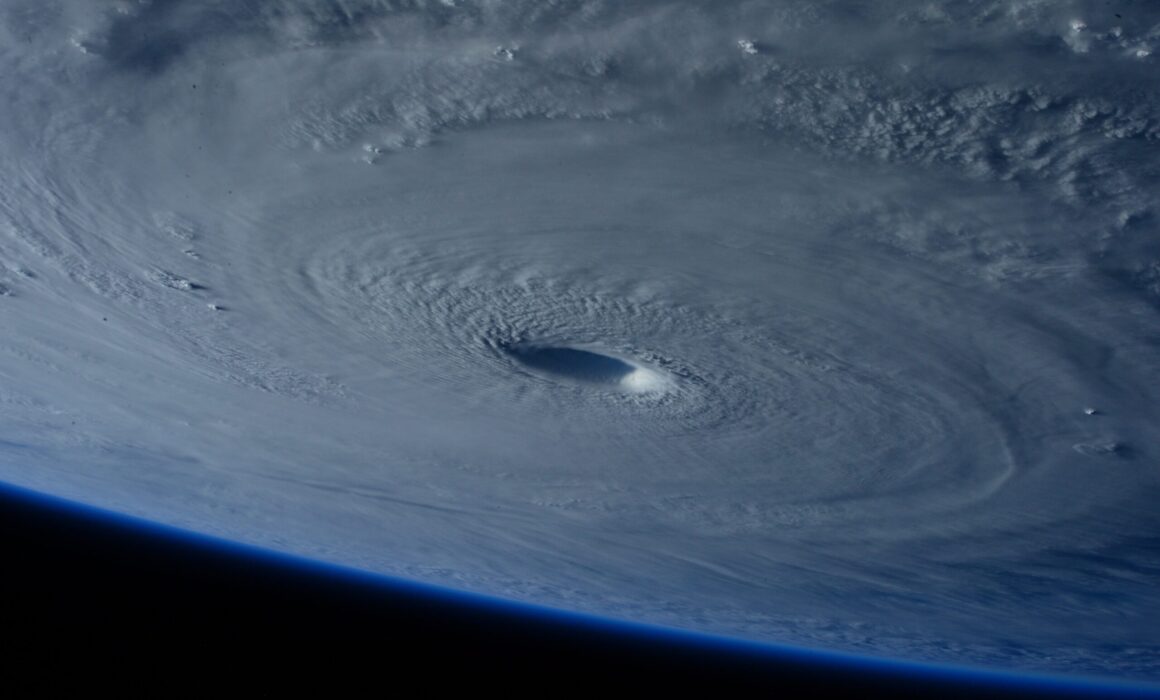

Hurricane Helene has left a trail of destruction across Florida, with high winds causing significant damage to homes and businesses. As property owners face the aftermath of this powerful storm, understanding your legal rights and options is essential in protecting your property and navigating the often complex process of insurance claims.

At Boggs Law Group, we’re here to provide guidance and legal support during this challenging time. Below, we cover the key points property owners should consider when dealing with wind damage caused by Hurricane Helene and how we can help.

1. Understanding Wind Damage

High winds from hurricanes can wreak havoc on properties, and understanding the types of damage they can cause is crucial when filing insurance claims. Common types of wind-related damage include:

- Roof Damage: Shingles may be torn away, leaving your home exposed to further damage from rain and debris.

- Broken Windows: Flying debris can shatter windows, causing potential structural harm and exposing interiors to the elements.

- Structural Damage: Strong winds can weaken the foundation of homes, cause cracks in walls, or even result in collapsed structures.

It’s important to document any visible damage as soon as possible after the storm. This will be crucial in supporting your insurance claim and ensuring that all damage is properly accounted for.

2. Legal Rights for Property Owners

As a property owner, you have legal protections under your insurance policy that are designed to cover storm-related damage, including wind damage. However, understanding the fine print of your insurance policy is essential, as there are often specific conditions regarding:

- Coverage for Wind Damage: Not all policies cover wind damage in the same way, and some may have specific deductibles for hurricane-related wind damage.

- Filing Deadlines: Many insurance policies have strict deadlines for filing claims after a storm. Missing these deadlines could jeopardize your ability to receive compensation.

- Exclusions and Limitations: Be on the lookout for any exclusions or limitations in your policy that could affect your coverage for certain types of wind damage.

Filing a claim for wind damage can be a complex process, with insurers often scrutinizing claims closely. Having a legal advocate by your side can help ensure that your rights are protected and that you receive the compensation you’re entitled to under your policy.

3. How Boggs Law Group Can Help

At Boggs Law Group, we have a proven track record of assisting property owners in Florida after hurricanes and storms. Here’s how we can support you:

- Navigating Insurance Claims: We’ll help you file a complete and accurate claim for wind damage and guide you through the often confusing and stressful process of dealing with insurance companies.

- Disputing Denied Claims: If your insurance company denies or undervalues your claim, we’ll fight for your rights, ensuring that you receive fair compensation for the full extent of the damage.

- Providing Peace of Mind: Our experienced attorneys have helped many clients recover after storm-related losses. For example, we recently assisted a Florida homeowner in securing full compensation for extensive roof and structural damage after an insurer initially denied the claim. Our expertise allowed the homeowner to rebuild and move forward with confidence.

Call Boggs Law Group Today

If you are facing challenges with your insurance claim due to wind damage from Hurricane Helene or need legal assistance to ensure your rights are protected, Boggs Law Group is here to help. We offer a free consultation to review your case and provide guidance on your next steps.

When the storm clears, let us be your trusted resource. Contact Boggs Law Group today, and let us help you through this difficult time with the confidence and legal support you need.